Sales Invoice

Expert

By Jad Ashi on March 28, 2023

A Sales Invoice is a bill that you send to your Customers against which the Customer makes the payment.

Sales Invoice is an accounting transaction. On submission of Sales Invoice, the system updates the receivable and books income against a Customer Account.

Home > Accounting > Accounts Receivable > Sales Invoice :

Before creating and using a Sales Invoice, it is advised to create the following first:

How to create a Sales Invoice ?

It can be created from a Sales Order or a Delivery Note. The Customer's Item details will be fetched into the Sales Invoice. However, you can also create a Sales Invoice directly, for example, a POS invoice.

______________________________________________________________

To fetch the details automatically in a Sales Invoice, click on the Get Items from. The details can be fetched from a Sales Order, Delivery Note, or a Quotation.

For manual creation, follow these steps:

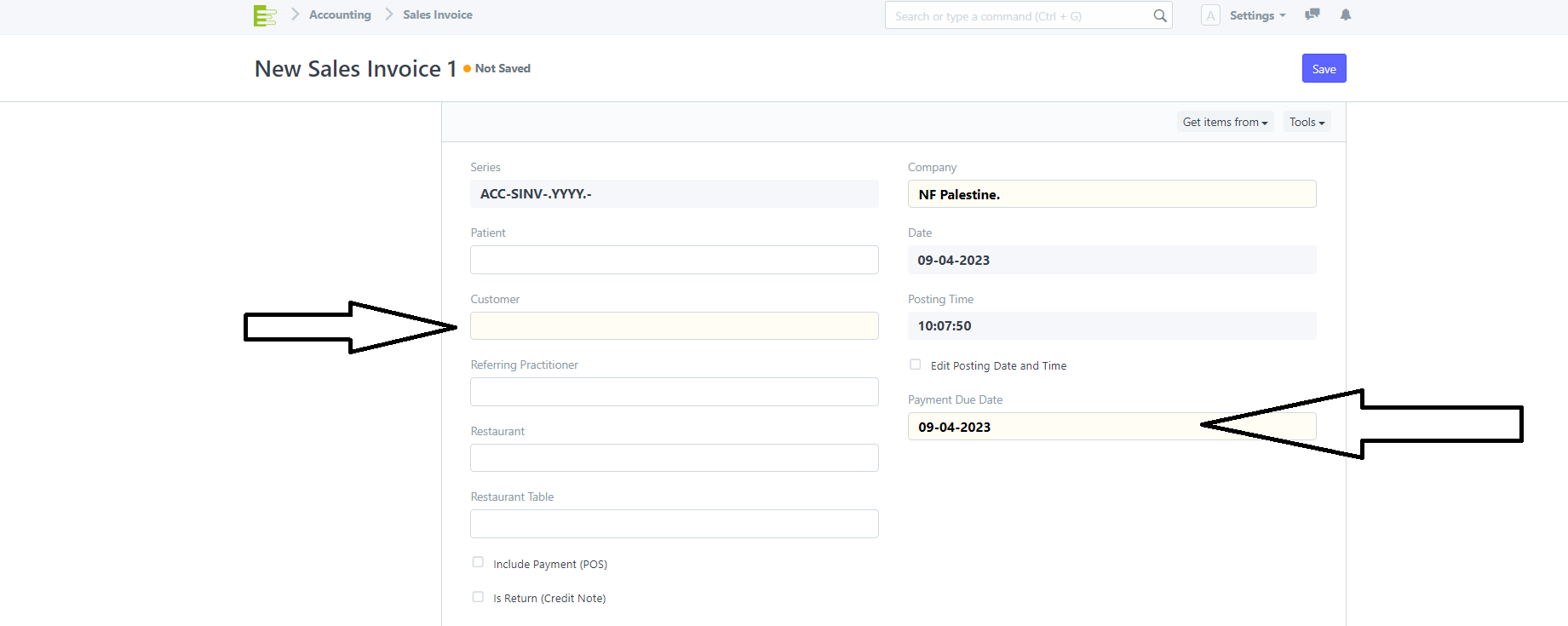

- Go to the Sales Invoice list and click on New.

- Select the Customer.

- Set the Payment Due Date.

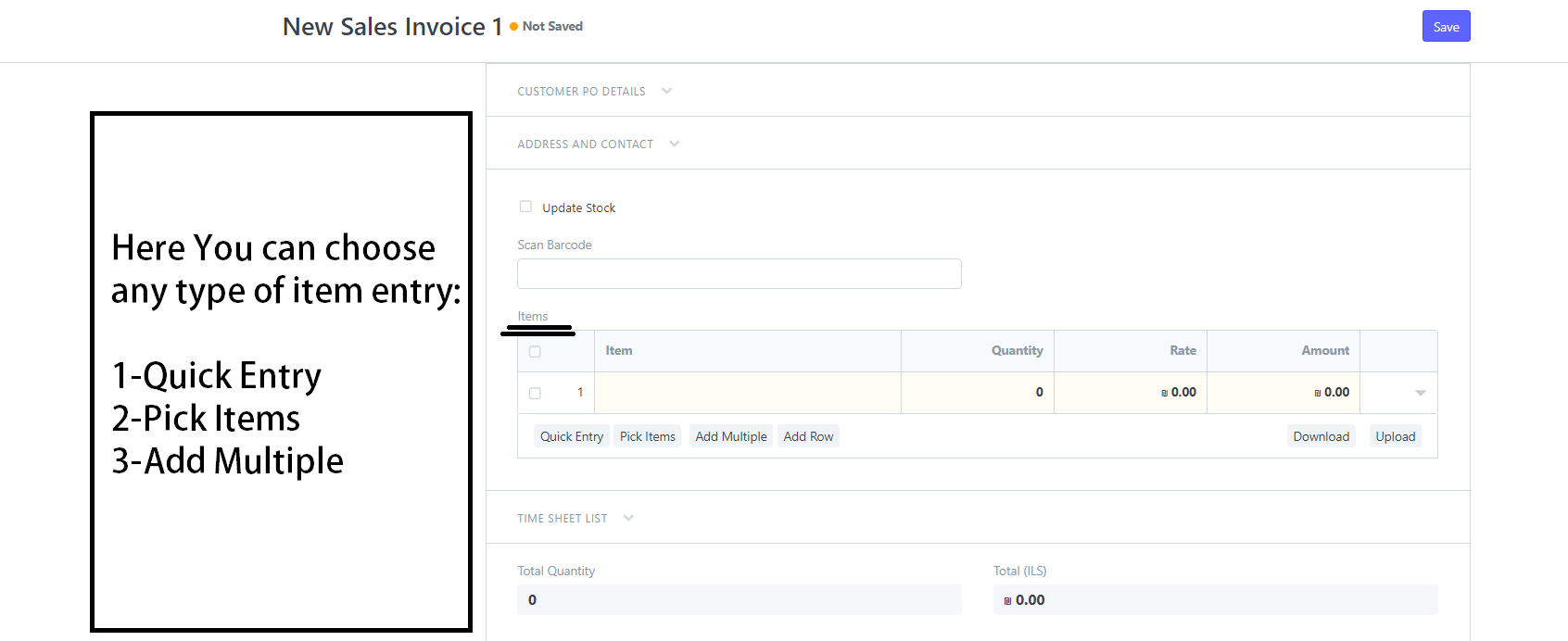

- In the Items table, select the Items and set the quantities.

- The prices will be fetched automatically if Item price is added, else add a price in the table.

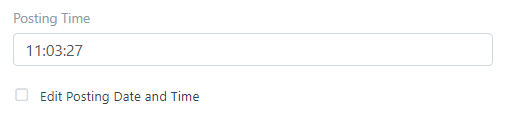

- The posting date and time will be set to current, you can edit after you tick the checkbox below Posting Time to make a backdated entry.

- Save and Submit.

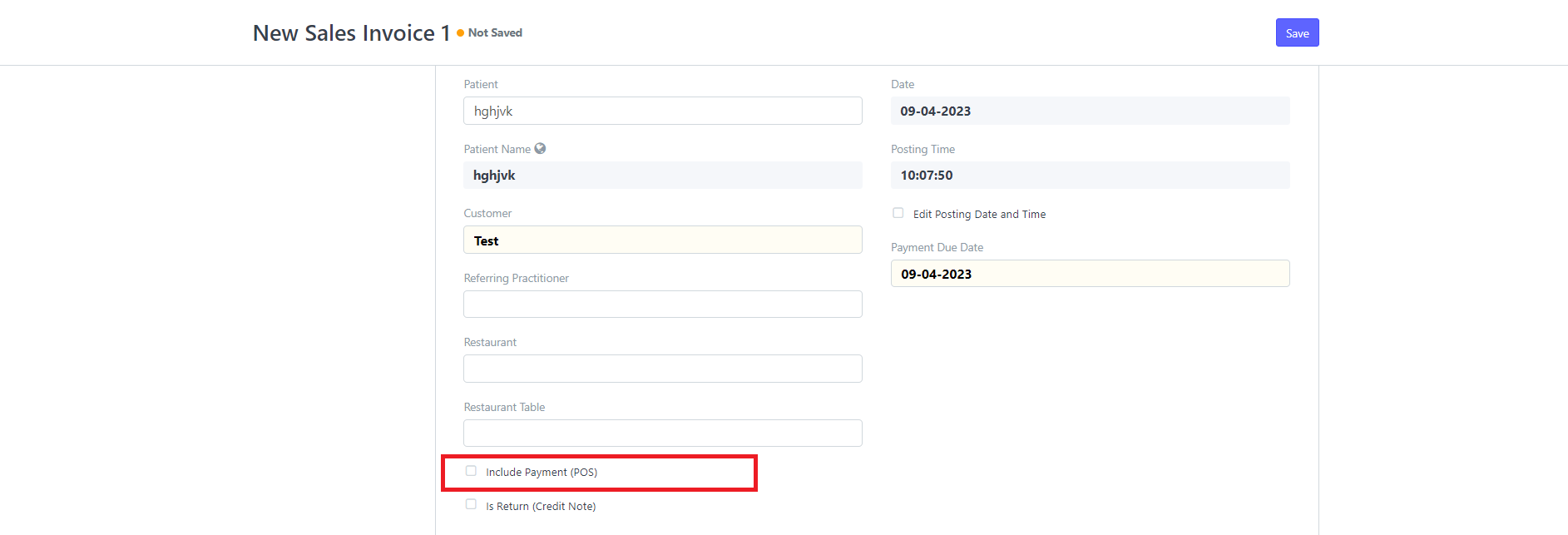

Additional options when creating a Sales Invoice

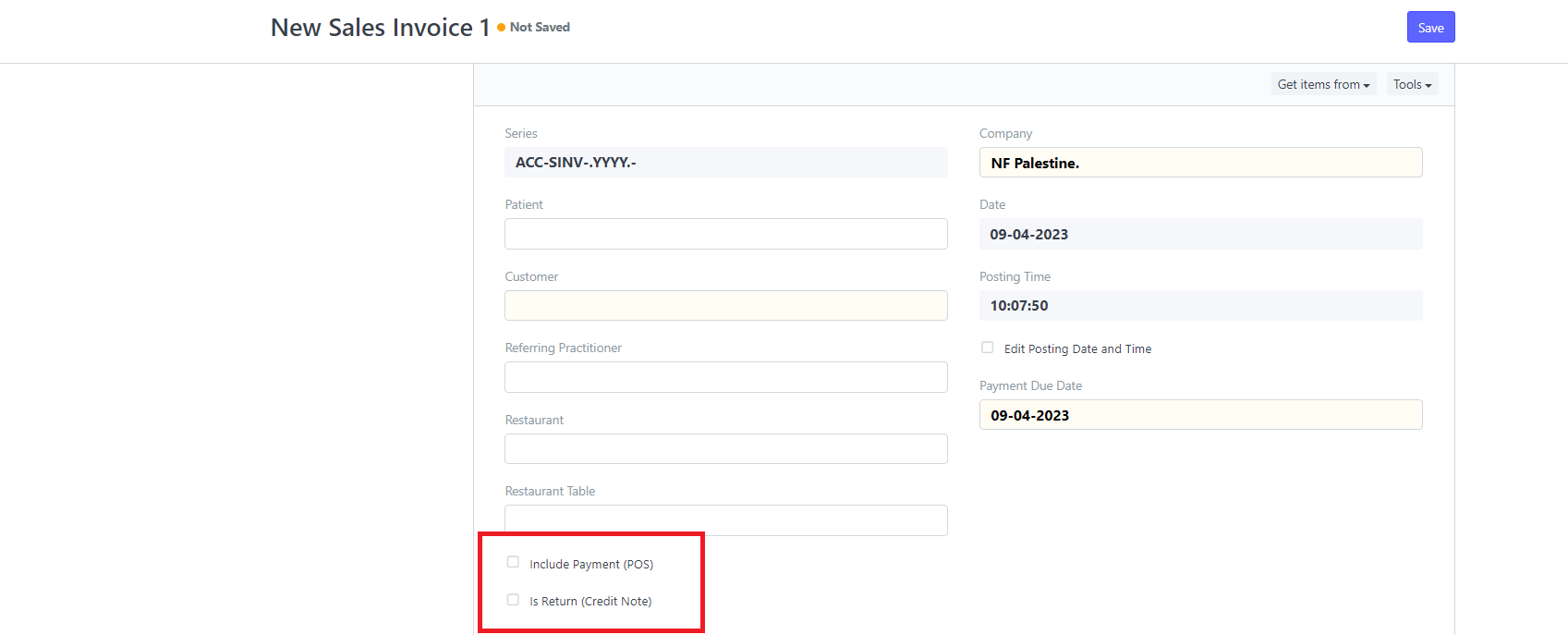

- Include Payment (POS): If this invoice is for retail sales / Point of Sale

- Is Return Credit Note: Tick this if the customer has returned the Items

Features:

Dates:

Posting Date: The date on which the Sales Invoice will affect your books of accounts i.e. your General Ledger. This will affect all your balances in that accounting period.

Due Date: The date on which the payment is due (if you have sold on credit). The credit limit can be set from the Customer master.

Accounting Dimensions:

Accounting Dimensions lets you tag transactions based on a specific Territory, Branch, Customer, etc. This helps in viewing accounting statements separately based on the selected dimension(s).

Note: Project and Cost Center are treated as dimensions by default.

Customer PO Details:

- Customer's Purchase Order: Track customer's PO No. received, primarily to prevent the creation of duplicate Sales Order or Invoice for the same PO received from the Customer. You can do more configuration related to customer's PO No. validation in Selling Settings

- Customer's Purchase Order Date: The date on which the Customer placed the Purchase Order.

Address and Contact:

- Customer Address: This is the Billing Address of the Customer.

- Contact Person: If the Customer is a company, the person to be contacted is fetched in this field if set in the Customer form.

- Territory: it is the region where the Customer belongs to, fetched from the Customer form. The default value is All Territories.

- Shipping Address: Address where the items will be shipped to.

Currency:

You can set the currency in which the Sales Invoice order is to be sent. This can be fetched from the Customer master or preceding transactions like Sales Order.

- Wish to select Customer's currency just for the reference of the Customer, whereas accounts posting will be done in the Company's base currency only.

- Maintain separate receivable account in the Customer's currency.

Price list:

If you select a Price List, then the item prices will be fetched from that list. Ticking on 'Ignore Pricing Rule' will ignore the Pricing Rules set in Accounts > Pricing Rule.

The Items table:

Update Stock: Ticking this checkbox will update the Stock Ledger on submitting the Sales Invoice. If you've created a Delivery Note, the Stock Ledger will be changed. If you're skipping the creation of Delivery Note, tick this checkbox.

Scan Barcode: You can add Items in the Items table by scanning their barcodes if you have a barcode scanner.

Grant Commission: Grant a commission to Sales Person and Sales Partner on the net amount of this line item. If disabled, this line item will be ignored in the calculation of commission.

The Item Code, name, description, Image, and Manufacturer will be fetched from the Item Master.

Discount and Margin: You can apply a discount on individual Items percentage-wise or on the total amount of the Item.

Rate: The Rate is fetched if set in the Price List and the total Amount is calculated.

Drop Ship: Drop Shipping is when you make the sales transaction, but the Item is delivered by the Supplier.

Accounting Details: The Income and Expense accounts can be changed here you you wish to. If this Item is an Asset, it can be linked here. This is useful when you're selling an Asset

Deferred Revenue: If the income for this Item will be billed over the coming months in parts, then tick on 'Enable Deferred Revenue'.

Item Weight: The Item Weight details per unit and Weight UOM are fetched if set in the Item master.

Stock Details: The following details will be fetched from the Item master:

- Warehouse: The Warehouse from where the stock will be sent.

- Available Qty at Warehouse: The quantity available in the selected Warehouse.

Batch No and Serial No: If your Item is serialized or batched, you will have to enter Serial Number and Batch in the Items table. You are allowed to enter multiple Serial Numbers in one row (each on a separate line) and you must enter the same number of Serial Numbers as the quantity.

Item Tax Template: You can set an Item Tax Template to apply a specific Tax amount to this particular Item.

Page Break will create a page break just before this Item when printing.

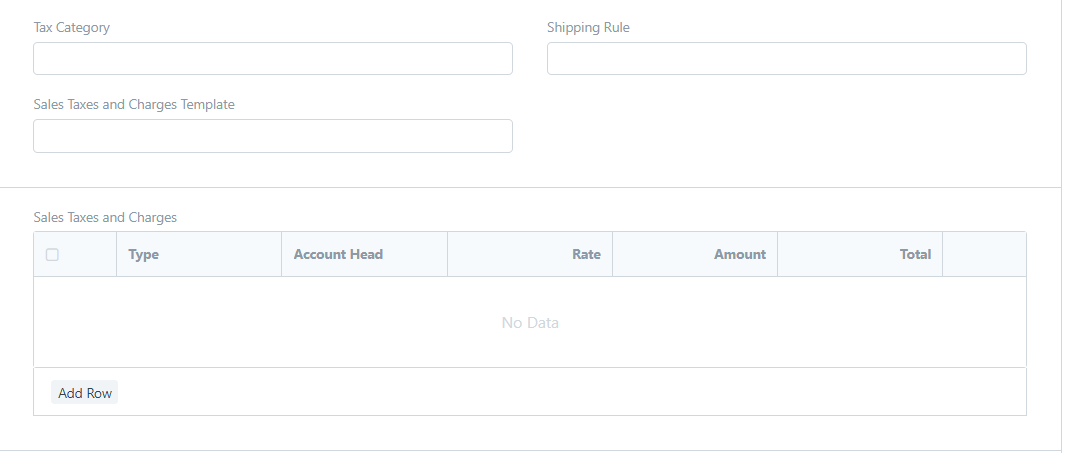

Taxes and Charges:

The Taxes and Charges will be fetched from the Sales Order or Delivery Note.

Visit the Sales Taxes and Charges Template page to know more about taxes.

The total taxes and charges will be displayed below the table.

To add taxes automatically via a Tax Category.

Make sure to mark all your taxes in the Taxes and Charges table correctly for an accurate valuation.

Shipping Rule:

A Shipping Rule helps set the cost of shipping an Item. The cost will usually increase with the distance of shipping.

Advance Payment:

For high-value Items, the seller can request an advance payment before processing the order. The Get Advances Received button opens a popup from where you can fetch the orders where the advance payment was made.

Payment Terms:

The payment for an invoice may be made in parts depending on your understanding with the Supplier. This is fetched if set in the Sales Order.

Write Off:

Write off happens when the Customer pays an amount less than the invoice amount. This may be a small difference like 0.50. Over several orders, this might add up to a big number. For accounting accuracy, this difference amount is 'written off'.

Terms and Conditions:

There may be certain terms and conditions on the Item you're selling, these can be applied here.

Sales Team:

Sales Persons: ERPMax Solutions allows you to add multiple Sales Persons who may have worked on this deal. This is also fetched from the Sales Order/Delivery Note.

Commission:

If the sale took place via one of your Sales Partners, you can add their commission details here. This is usually fetched from the Sales Order/Delivery Note.

Printing Settings:

Letterhead

You can print your Sales Invoice on your Company's letterhead.

'Group same items' will group the same items added multiple times in the Items table. This can be seen when your print.

Print Headings

Sales Invoice headings can also be changed when printing the document. You can do this by selecting a Print Heading.

( There are additional checkboxes for printing the Sales Invoice without the amount, this might be useful when the Item is of high value. You can also group the same Items in one row when printing. )

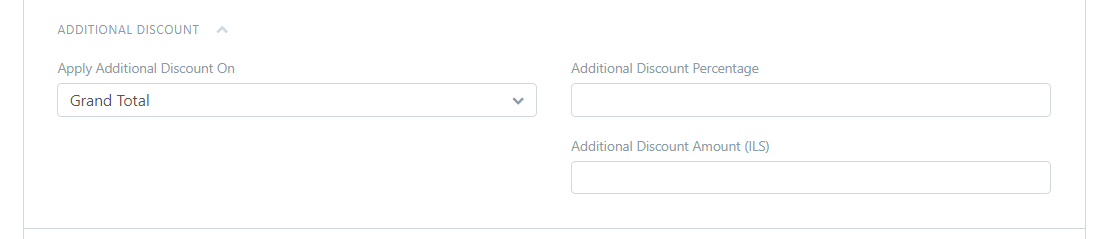

Additional Discount:

Any additional discounts to the whole Invoice can be set in this section. This discount could be based on the Grand Total i.e., post tax/charges or Net total i.e., pre tax/charges. The additional discount can be applied as a percentage or an amount

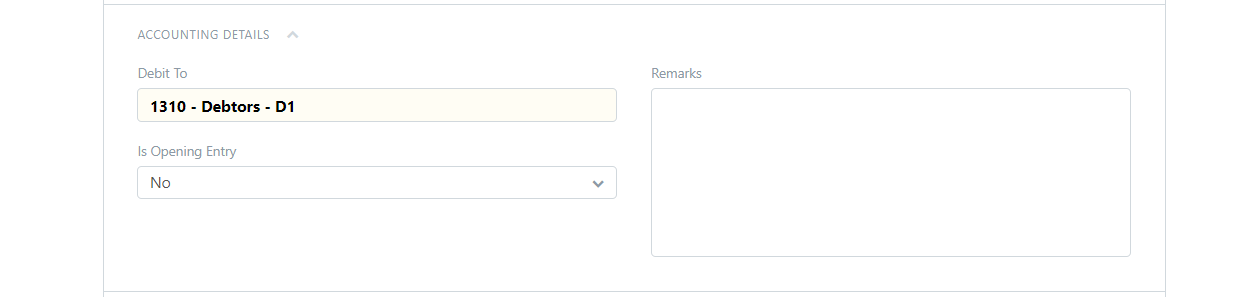

Accounting Details:

- Debit To: The account against which receivable will be booked for this Customer.

- Is Opening Entry: If this is an opening entry to affect your accounts select 'Yes'.

- Remarks: Any additional remarks about the Sales Invoice can be added here.

POS Invoices:

Consider a scenario where the retail transaction is carried out. For e.g: A retail shop. If you check the Is POS checkbox, then all your POS Profile data is fetched into the Sales Invoice and you can easily make payments.

Also, if you check the Update Stock the stock will also update automatically, without the need for a Delivery Note.

After Submitting:

On submitting a Sales Invoice, the following documents can be created against it:

- Journal Entry

- Payment Entry

- Payment Request

- Invoice Discounting

- Delivery Note

Comments

No comments yet. Start a new discussion.

Leave a Comment